Why Most Graduates End Up Broke and How You Can Avoid It

January 15, 2026

Mehmil

Most students think, “I’ll deal with money later… I’m still studying lah.”

But later is exactly when money hits the hardest, especially for students planning to study in Malaysia or continue their studies at top Malaysian universities.

The truth is, most graduates don’t end up broke because of their first job — they end up broke because they waited too long to start any kind of financial planning. And yes, that means before graduation.

Most students assume financial planning for students is something “adulting you” will magically figure out after convocation. Spoiler: adulting you is still the same you… just with more bills.

So if you’ve been telling yourself:

“I’ll start budgeting after I get my first salary.” or “I don’t make enough to save anyway.”

Congratulations — you’re participating in the most common financial mistake students make.

Don’t worry, it’s fixable.

And we’re about to break it down in the simplest, most student-friendly way possible.

Ready? Let’s save you from future financial chaos.

The Broke Graduate Trap (And Why It Happens to Almost Everyone)

Let’s be honest — most students grow up believing “first job = financial freedom.”

Like magically, once you start earning, your bank account will heal itself, savings will appear, and life will finally stop being expensive.

Yeah… no. Here’s the real equation:

First job = bills + rent + transport + taxes + random adulting expenses you never knew existed.

This is why so many fresh grads start searching things like “Why does my salary disappear so fast?” within their first month of working.

The financial shock is real — and it hits hardest in the first 3–6 months after graduation.

That’s when you realise:

- Your salary isn’t actually your salary (hello, deductions).

- Rent is no joke.

- Transport quietly drains your wallet.

- And suddenly you need “work clothes,” “work shoes,” and “work everything.”

This is exactly why early financial planning for students matters.

If you wait until you’re already drowning in expenses, it’s too late to build good money habits.

Starting early gives you a safety cushion and keeps you out of the broke graduate trap almost everyone falls into.

What Students Think Will Fix Their Money (But Won’t)

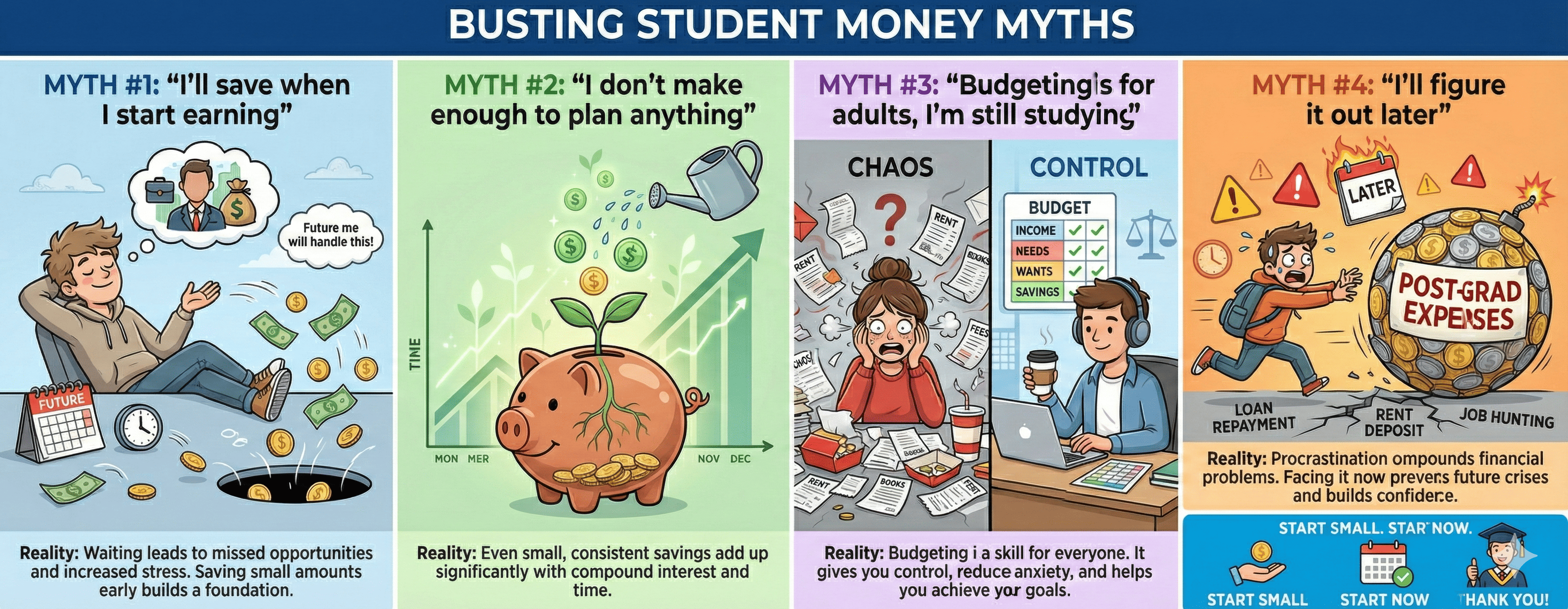

Ah, the classic student money myths. Let’s bust them!

Myth #1: “I’ll save when I start earning.”

Reality: Your spending habits are already forming. Start now, or your first salary will vanish faster than your weekend plans.

Myth #2: “I don’t make enough to plan anything.”

Reality: Even RM50–RM100 a month teaches you budgeting, saving, and financial discipline. Financial planning for students isn’t about big amounts — it’s about smart habits.

Myth #3: “Budgeting is for adults, I’m still studying.”

Reality: Budgeting now = less stress later. Search “student money management tips” and you’ll see, planning early beats panic later.

Myth #4: “I’ll figure it out later.”

Reality: Spoiler: later turns into post-graduation chaos. Start small, learn financial literacy for students, and your future self will high-five you.

Students, don’t wait! Money mistakes compound faster than you think! 💸

The Real Problem: Zero Financial Habits Before Graduation

Here’s the ugly truth: most students don’t struggle because they earn too little; they struggle because they never learned basic financial habits.

Think about it:

❌ You don’t track your spending, so money disappears without a clue.

❌ You have no savings routine, not even a tiny stash for emergencies.

❌ You don’t have an emergency fund, so one broken laptop or last-minute exam fee = instant panic.

❌ You don’t know how to handle unexpected costs, from transport hiccups to sudden project expenses.

Sound familiar? That’s why search queries like “financial literacy for students” and “student money management tips” are trending — everyone realizes too late that money skills matter before graduation, not after.

The Student Years Are Actually Your Cheapest Years (Use Them)

Your wallet gets tested hard after graduation. Rent, transport, deposits, work clothes, and even job search costs sneak up fast.

Meanwhile, student life is a goldmine for low-cost living: subsidised dorms, cheaper meals, and fewer adult responsibilities.

Even saving just RM50–RM100 a month now teaches budgeting, builds a savings habit, and creates a small cushion for the future. Start early, practice student money management, and your post-grad self won’t be scrambling every month.

Small efforts now = big relief later!

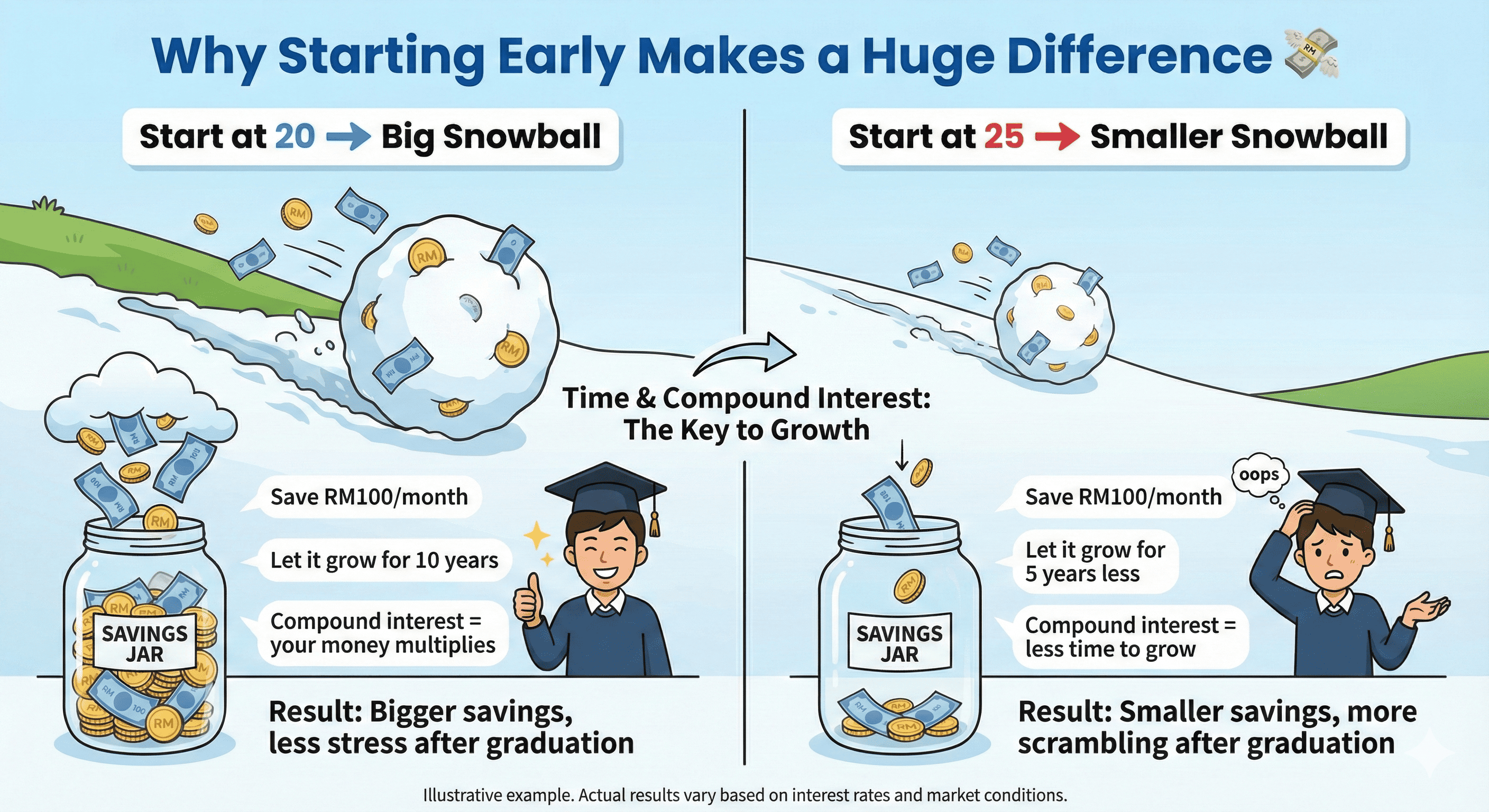

Compounding for Students (Explained in a Zero-Boring Way)

Here’s a fun truth: “Future You will thank Present You.” Sounds cheesy, but it’s basically the magic of compounding. Start saving now, even small amounts, and your money grows like a snowball — faster than your Netflix watchlist.

Imagine this: you start saving RM100 a month at 20 vs starting at 25. By the time you’re 30, your early-start savings could be 30–50% more — all from a few extra years of compounding.

That’s why financial planning for students isn’t about huge amounts, it’s about starting early.

Even pocket money, part-time earnings, or a tiny side hustle can turn into a serious cushion if you let it grow.

Side Hustles You Can Start Now (No Cash Needed)

Who says you need a fat wallet to start making money as a student? 💸

The truth is, side hustles for students 2025 are all about creativity, skills, and hustle, not starting capital.

Here are some fun, easy ways to get rolling:

| Side Hustle | What You Do | Why It Works for Students |

|---|---|---|

| Freelancing | Writing, editing, graphic design, or coding | Use your skills, flexible hours, build portfolio |

| Remote Part-Time Jobs | Customer support, virtual assistant, social media management | Work from anywhere, gain real job experience |

| Online Tutoring | Teach peers or younger students online | Share knowledge, reinforce skills, earn cash |

| TikTok/IG Content Services | Create videos, graphics, manage social pages | Fun, creative, high demand for digital skills |

| Selling Small Services | Proofreading, CV help, digital templates | Minimal investment, instant start, builds financial habits |

The 5 Money Moves Every Student Should Make Before Graduation

Alright students, let’s get real — building financial literacy for students doesn’t have to be complicated.

Here are 5 simple, zero-stress money moves you can start before graduation:

1. Create a simple budget (5-minute version): Track your income and expenses without turning it into a full-time job. Search “student money management tips” for easy templates.

2. Start a tiny emergency fund: Even RM50/month creates a safety net for unexpected expenses.

3. Track spending for 1 month: Knowing where your money goes = instant money hacks.

4. Learn one new money skill: Try a budgeting app, Excel tricks, or basic investing. Every skill counts.

5. Build a small income stream: Freelance, tutoring, or online gigs. A little side hustle goes a long way.

Do these now, and your post-grad self will be less stressed, more confident, and way richer in financial habits.

The First Job Reality Check: What Your Salary Actually Looks Like

Congrats, you got your first job! 🎉 But before you plan that shopping spree, let’s have a reality check. Your salary isn’t exactly what you think it is.

Here’s what eats it up fast:

- Taxes – income tax is real, and it comes first.

- EPF/CPF/SSS – retirement contributions you can’t skip.

- Rent – suddenly your dorm days feel like a dream.

- Transport – fuel, rideshares, or public transit adds up.

- Food – your mom’s cooking is now optional.

- Insurance – medical and other essentials aren’t free.

This is exactly why financial planning for students and building habits before graduation is a game-changer. Start early, so your first paycheck actually feels like freedom — not panic.

How Early Planning Gives You a 2-Year Head Start

Starting your money habits before graduation isn’t just smart, it’s like giving yourself a 2-year head start on adulting.

Think about it: if you start small now with budgeting, saving, and tracking spending, you’re building better savings habits without even feeling it.

By the time your first salary hits, you’re not scrambling, you’re already comfortable with money.

You’ll feel less pressure during your first job, because money decisions won’t feel like a fire you can’t control. And when you’re financially secure, you get more freedom to make career choices; like internships, side projects, or further studies.

Want even more money-saving hacks for students? Check out our guide on how to save money as a student. It’s packed with practical student money tips, smart budgeting tricks, and side hustle ideas.

Future You Is Closer Than You Think

Your future self isn’t decades away, it’s just a few smart choices from now.

The money habits you start today like tracking spending, saving even a little, learning budgeting apps, or starting a small side hustle — compound into confidence, stability, and freedom tomorrow.

No guilt trips here. You don’t need to have it all figured out right now. Even small steps count. So pick one habit, try it this week, and watch how your control over money grows.

Future you will thank you for every RM saved, every skill learned, and every smart choice made today.

Start small, start now, and own your post-grad life like a boss.

Frequently Asked Questions

1. How can students start managing money with zero income?

You don’t need a salary to build good student money management habits. Use a simple budgeting app, set weekly spending limits, and learn basic financial literacy for students like needs vs wants. When income eventually comes in; part-time, allowance, or your first job, you’ll already know how to manage it instead of overspending.

2. What is the best way for students to save money while studying?

Start small. Even RM50–RM100 a month helps you build the habit. Look for savings opportunities in food, transport, and subscriptions. Use student discounts, avoid impulse buys, and set up a mini emergency fund. These habits are the foundation of how to save money as a student and make the transition to working life way easier.

3. How much should a student save every month in Malaysia?

There’s no fixed number, but most students aim for RM50–RM150 a month. The goal isn’t the amount — it’s the consistency. With rising student expenses in Malaysia, building small savings early gives you a cushion for emergencies, internships, and job-hunting costs later.

4. What are the best side hustles for students in 2025?

Trending side hustles for students 2025 include online tutoring, freelance writing/design, TikTok/IG content services, remote admin work, and micro-gigs like editing or transcription. You don’t need money to start, just skills and consistency. These small income streams boost your budget and help you build valuable experience before graduating.

5. Why do graduates struggle financially in their first year?

Most graduates expect their first job to fix everything. Instead, they face rent, transport, taxes, deposits, insurance, and unexpected costs all at once. Without early planning or financial literacy for students, the first 3–6 months become a financial shock. Starting money habits while studying prevents this “broke graduate” phase.

6. How can students build financial literacy before graduation?

Start by learning budgeting basics, tracking expenses, and understanding how savings work. Follow student-friendly finance pages, watch short videos, or try free budgeting apps. The earlier you build financial literacy for students, the more confident you’ll feel when your first paycheck comes in.

Kickstart your education in Malaysia

We'll help you find and apply for your dream university

You might be interested in...

- 12 Smart Ways to Save Money as a Student in 2026

- Top Actuarial Science Universities in Malaysia for International Students 2026

- Language Barrier Between International And Local Students

- How University Students Should Prepare For Work?

- Cost of Living in Malaysia for International Students 2026

- How Can International Students Work in Malaysia After Graduation

- Semester Break Exploration Guide For International Students in Malaysia

- Language and Communication Tips for International Students Studying in Malaysia

- The Cultural Experience of Being A Student in Malaysia

- Students Accommodation in Malaysia for International Students 2026

+60173309581

+60173309581